Decoding the Boom in Industrial Real Estate: A Comprehensive Guide

The industrial real estate sector has been booming more than ever, with warehouses and distribution centers becoming hot commodities. The shift in consumer behavior towards online shopping, accelerated by the pandemic, has ignited this growth. But, what does this mean for investors and what are the potential challenges that may arise? In this article, we'll delve into the dynamics of the industrial real estate market, its current trends, potential risks, and its overall impact on the real estate industry.

The Rise of Industrial Real Estate: A Historical Overview

Industrial real estate, which includes warehouses, distribution centers, and manufacturing facilities, has traditionally been a stable but not particularly glamorous part of the real estate industry. In the past, the sector was primarily driven by manufacturing activities. However, over the last decade, things have changed dramatically.

The advent and rise of e-commerce have fundamentally transformed the demand for warehouses and distribution centers. As more consumers shifted to online shopping, retailers needed more space to store their goods and manage their distribution. The COVID-19 pandemic further accelerated this trend, pushing companies to rethink their supply chain and distribution strategies, thereby leading to an increased demand for industrial real estate.

Current Trends in Industrial Real Estate

The current market trends in industrial real estate are dominated by a few key factors. Firstly, the demand for space continues to be strong, driven by e-commerce growth. According to a recent report by JLL, demand for industrial real estate in the US is expected to reach 1 billion square feet by 2025.

Secondly, the location of these properties is becoming increasingly important. Proximity to major cities and transportation hubs is a significant factor as it allows for faster delivery times, a crucial aspect of e-commerce operations.

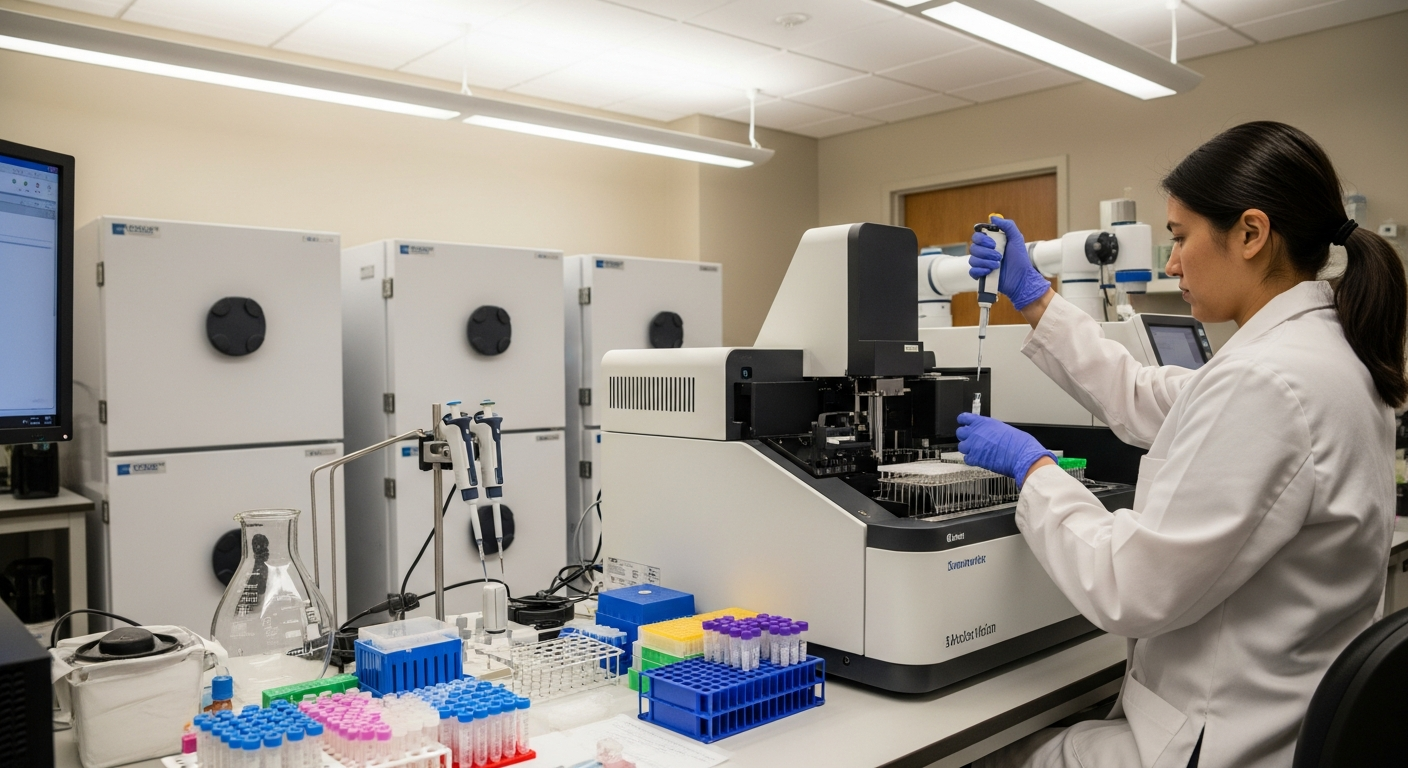

Finally, the trend towards automation and the use of advanced technology in warehouses and distribution centers is also shaping the sector. Properties that can accommodate these technologies are in high demand.

The Pros and Cons of Investing in Industrial Real Estate

Investing in industrial real estate presents several advantages. High demand and low supply have led to an increase in rental rates, offering attractive returns for investors. Additionally, industrial properties generally require less maintenance than other types of properties, reducing operating costs.

However, there are also potential challenges. The rapid evolution of technology could make some properties obsolete if they can’t accommodate new systems. Furthermore, changes in trade policies or economic downturns could potentially affect demand.

The Impact of the Industrial Real Estate Boom

The boom in industrial real estate is reshaping the broader real estate market. It’s attracting more investors who traditionally focused on other sectors, such as office or retail. This shift in investment could potentially lead to a redistribution of capital and impact property values in other sectors.

Looking Ahead: The Future of Industrial Real Estate

As e-commerce continues to grow and technology advances, the demand for industrial real estate is likely to remain strong. However, investors must stay vigilant to the potential risks and ensure that their investments can adapt to the changing landscape.

In conclusion, the industrial real estate sector is currently experiencing a boom, driven by e-commerce and technological advancements. While this presents exciting opportunities, understanding the market dynamics, trends, and potential risks is crucial for making informed investment decisions.